Electronic Payments System Client-Bank

New Level of Convenience

- Customisable and simple interface

- Templates for payment instructions and applications

- Actual directories

- History storage

- Multi-user functionality

- The system is functional after the end of the operational day

- Expansion of capacities and automated software updates

- Information support +375 17 289 90 40

Firm Confidence in Security

- Document preview

- Control of each stage of the document processing in the bank

- Certified cryptographic protection system

- Delineation of powers

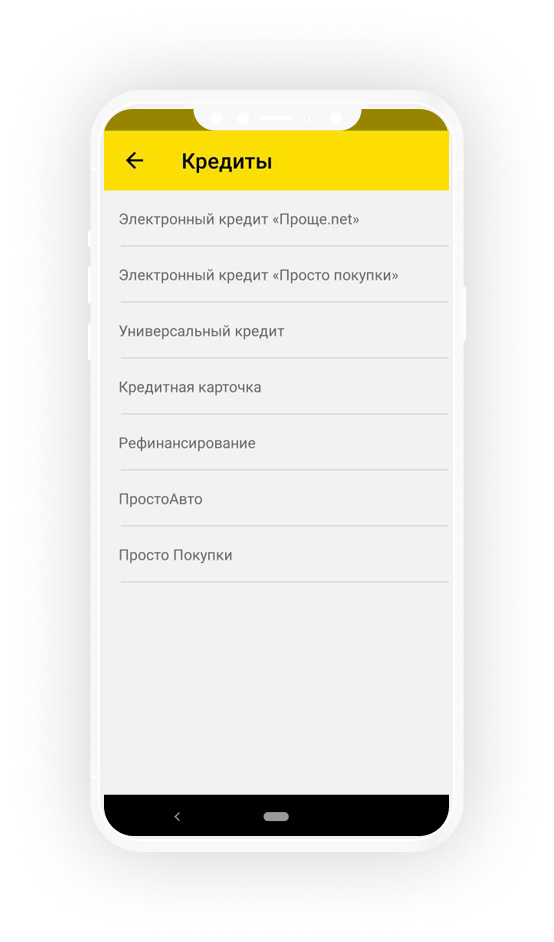

Why the Client-Bank is so convenient?

-

Settable and simple interface

Setting of printing forms in graphical or text format, "enquiries navigator" which enables to view all the today's enquiries.

-

Templates of payment instructions and applications

Possibility to create templates of the most often used documents.

-

Actual directories

Create templates of loyal customers with their requisites (Company name, MFO (sort code) and name of the bank, settlement account).

-

Storage of each document history

The system enables to store the documents archives.

-

Multi-user regime

Several users with different access roles for tasks, accounts and requests can simultaneously operate in the system.

-

The system is functional after end of the operational day

Send electronic documents at any time – the Bank will process them as soon as the new Operational Day begins.

-

Automated software updates

The Client-Bank System has a module structure and is easily expanded.

-

Information support

Should You have any questions related to the System operation, please, apply to Your Banking Services Center, as well as over the phone +37517 289 90 40, for A1 and MTS subscribers - 487, for Minsk - 187.

-

Document preliminary control

Correctness and completeness of fields filling, compliance with the directories are controlled.

-

Control of each stage

You can view the document processing status stage by the Bank with each communication session with the Bank.

-

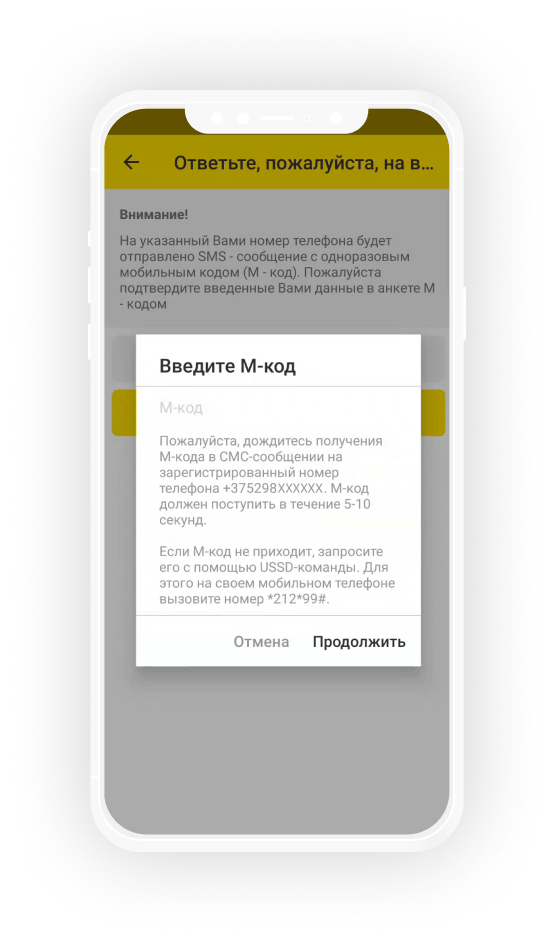

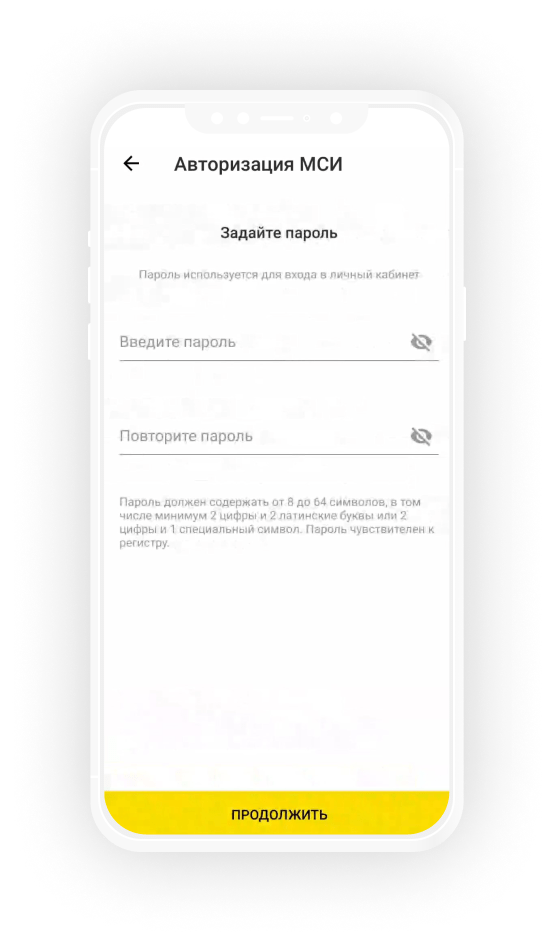

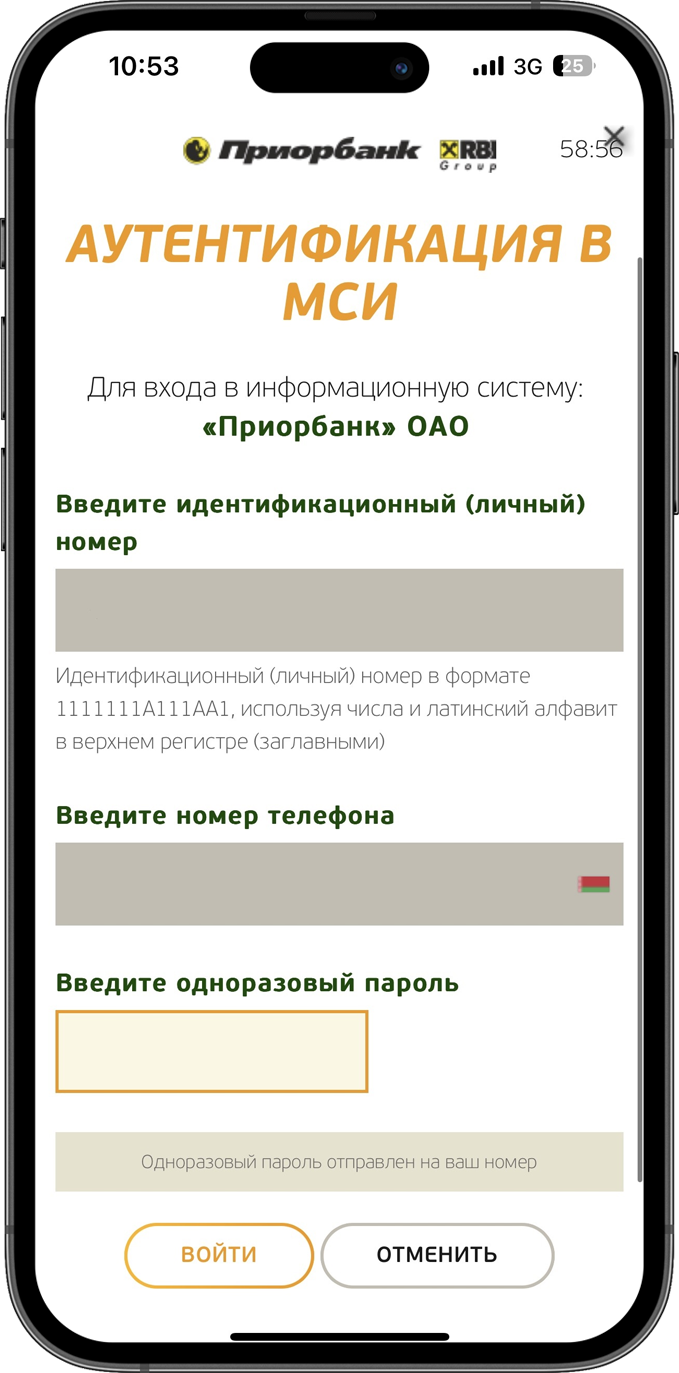

Certified cryptographic protection system

Documents encryption and signing them with Your personal secret key ensures full security of Your electronic workflow.

-

Delineation of powers

Each user receives a specific role with a predefined tasks set.

How does the Client Bank System operate?

-

Step 1.

Preparation

The respective software is installed on your computer. Priorbank creates an e-mail box for you.

-

Step 2.

Enquiry

Your computer is connected to the software and hardware appliance of the bank via a modem or the Internet (at your discretion).

During the communication session, your computer transmits electronic messages (enquiries) to the bank, which enter the bank's e-mail box.

-

Step 3.

Reply

The Bank replies to your enquiries via e-mail. During the next communication session you can read it.

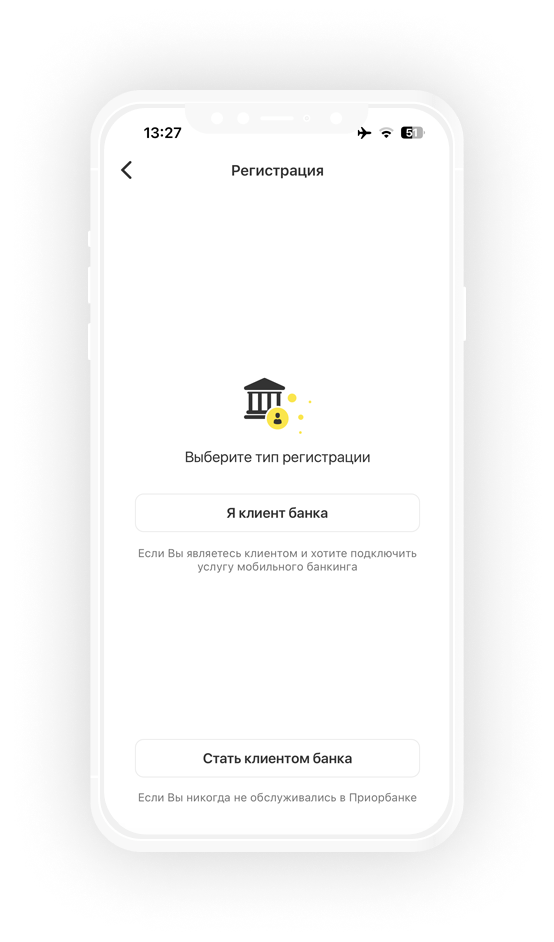

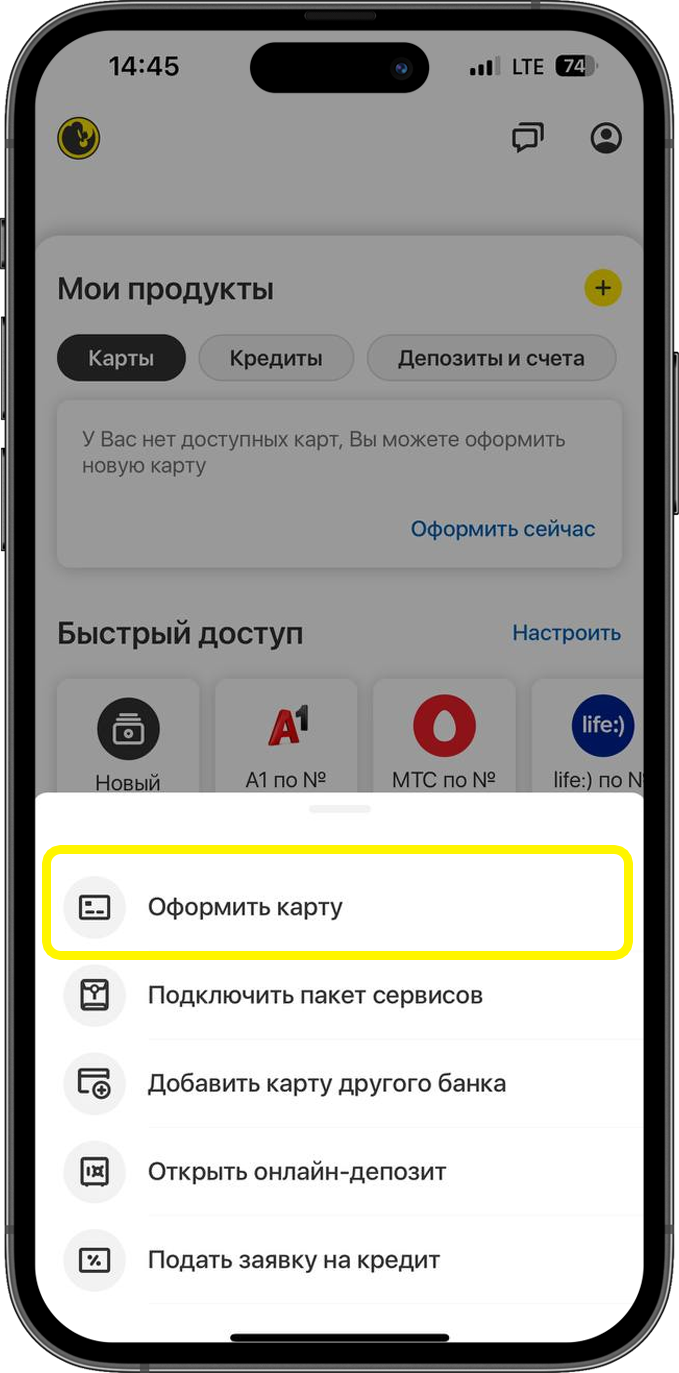

How can I connect to the Client-Bank?

-

Step 1.

Read the Service Terms

To be connected:

- Check your workstation compliance with technical parameters (Technical requirements for the Client-Bank System)

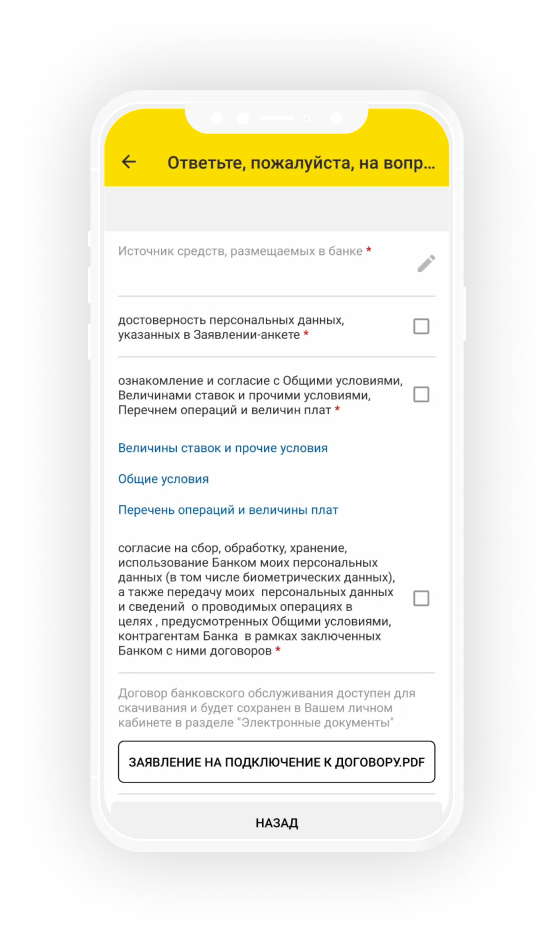

- Read the General Terms of Settlement and Cash Servicing for Priorbank JSC Clients -

Step 2.

Create an Application

Create an application at the Banking Services Center

-

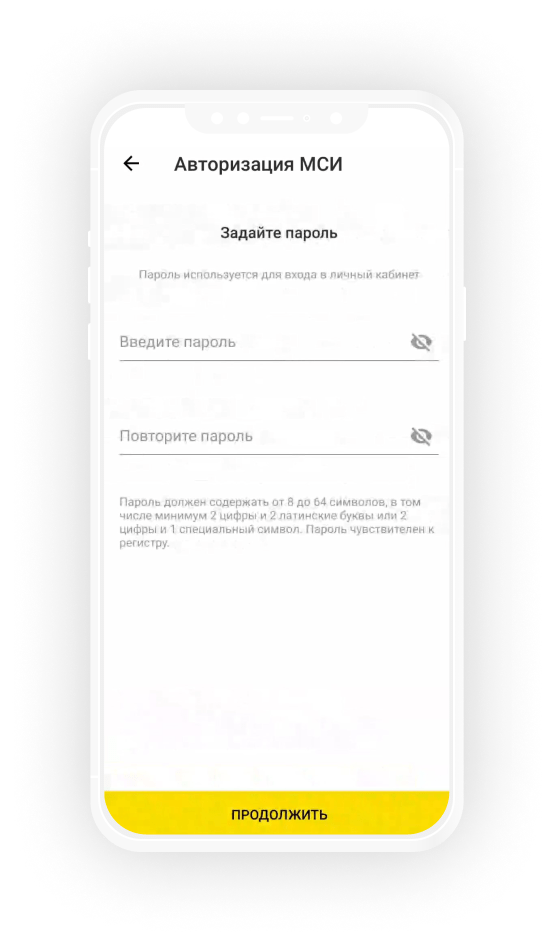

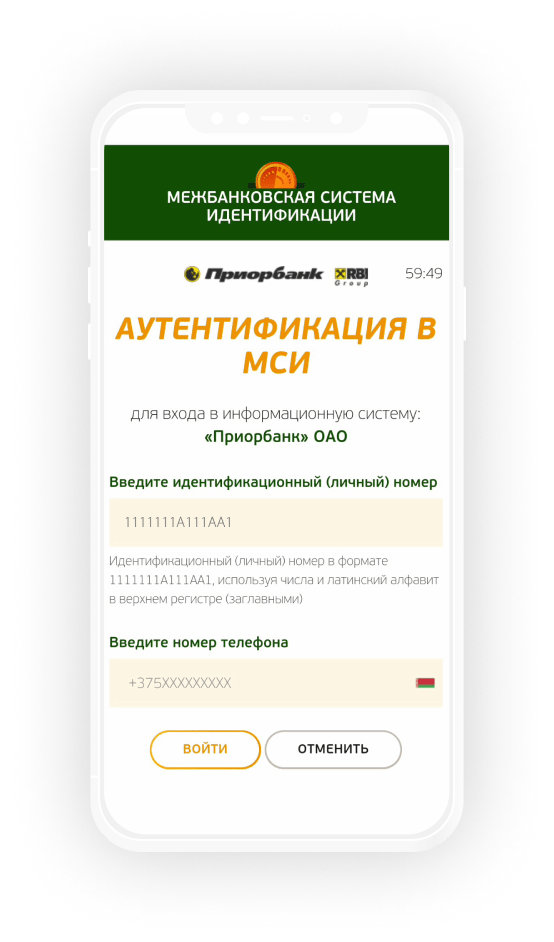

Step 3.

Install Client-Bank

The System is installed with the assistance of the bank's technical consultant.

To start using the System:

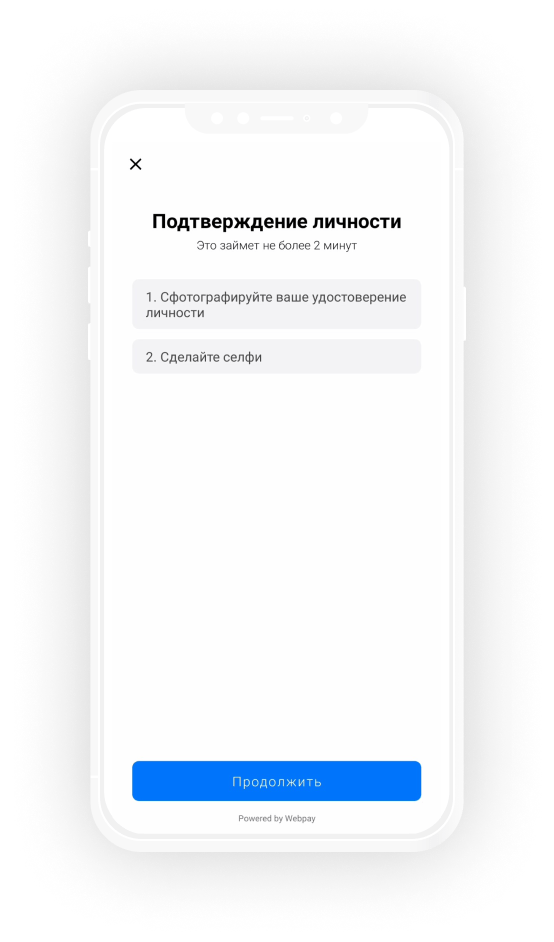

- create encryption protection keys and exchange them with the bank

- sign the open key card for verification of your signature

.jpg)

оснащенность встроенным сканером штрих-кода и QR-кода;

оснащенность встроенным сканером штрих-кода и QR-кода;