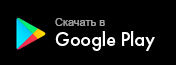

Direct Export Factoring with Recourse

A fast and convenient method of export transactions financing with the possibility to service deliveries in favor of any debtors from distant foreign and CIS countries

Direct Export Factoring with Recourse

A fast and convenient method of export transactions financing with the possibility to service deliveries in favor of any debtors from distant foreign and CIS countries

Fast Working Capital Replenishment

Exclusion of cash gaps, the possibility to provide competitive payment deferrals to the buyers and clearly plan cash flow.

The popularity of international factoring with recourse among Belarusian exporters is explained by its simplicity and relatively low cost, as the risk of full or partial non-payment by the debtor is taken on by the seller.

Factoring Terms and Conditions

Factoring Type: Factoring can be with notification of the foreign buyer about Assignment of Accounts Receivables (A/R) or without notification (hidden).

- with recourse, i.е. the risk of non-payment by the debtor is taken by the seller.

Financing Size: up to 100% from the amount of the assigned A/R less the discount.

Financing Currency: the currency corresponds the contractual currency.

Maximum payment terms: up to 180 calendar days.

Additional period: up to 90 calendar days. Upon elapse of this period the Bank will apply to the Seller the recourse right on the debt payment.

Collateral: the Bank may require additional collateral.

Attention! The Bank finances the Seller on cash claims, maturity of which has not elapsed as of the financing date.

Factoring Advantages

-

Reliable Partner

Priorbank has been operating on the Belarusian factoring market since 2010, and is a member of the international factoring association Factors Chain International (FCI).

Priorbank was recognised as the best on the international factoring market by the International Factors Group (IFG) in 2014. Today IFG is a part of the FCI. (since 2016)

-

Payment received of on the shipment date

Enjoy convenient and fast way of financing

-

FX Risks Hedging

Minimize your losses from FX differences

-

Long-Term Deferrals

Possibility to provide deferrals of up to 180 calendar days, being in compliance with foreign currency legislation requirements.

-

For Any Purposes

Dispose of the factoring funds at your discretion.

-

Compliance with foreign trade legislation

Closing of foreign trade transactions and ensuring the return of foreign currency revenues at the moment of financing receiving.

-

Universality

Factoring servicing of deliveries to any buyers from any countries of the world, as well as to the companies affiliated and connected to the supplier.

.png)

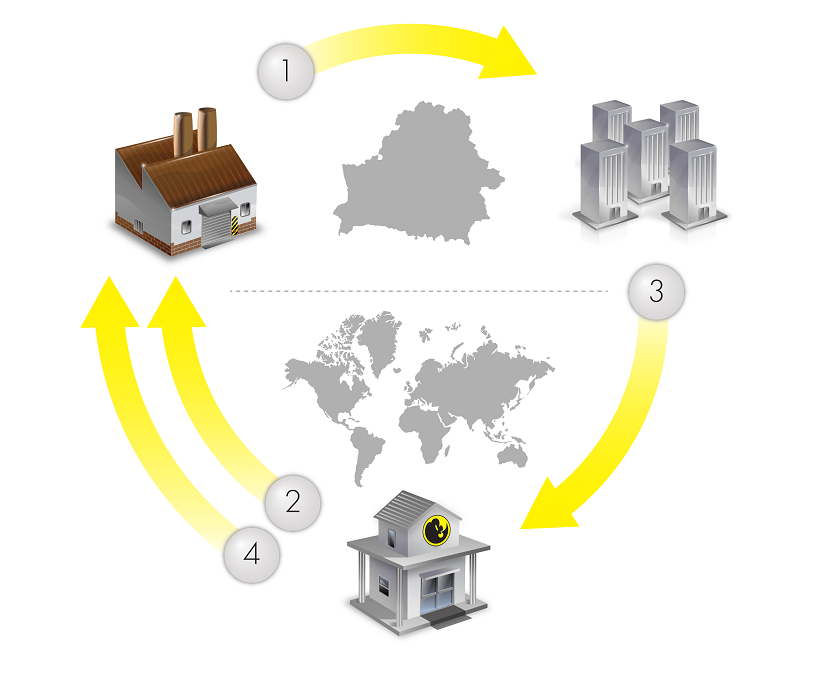

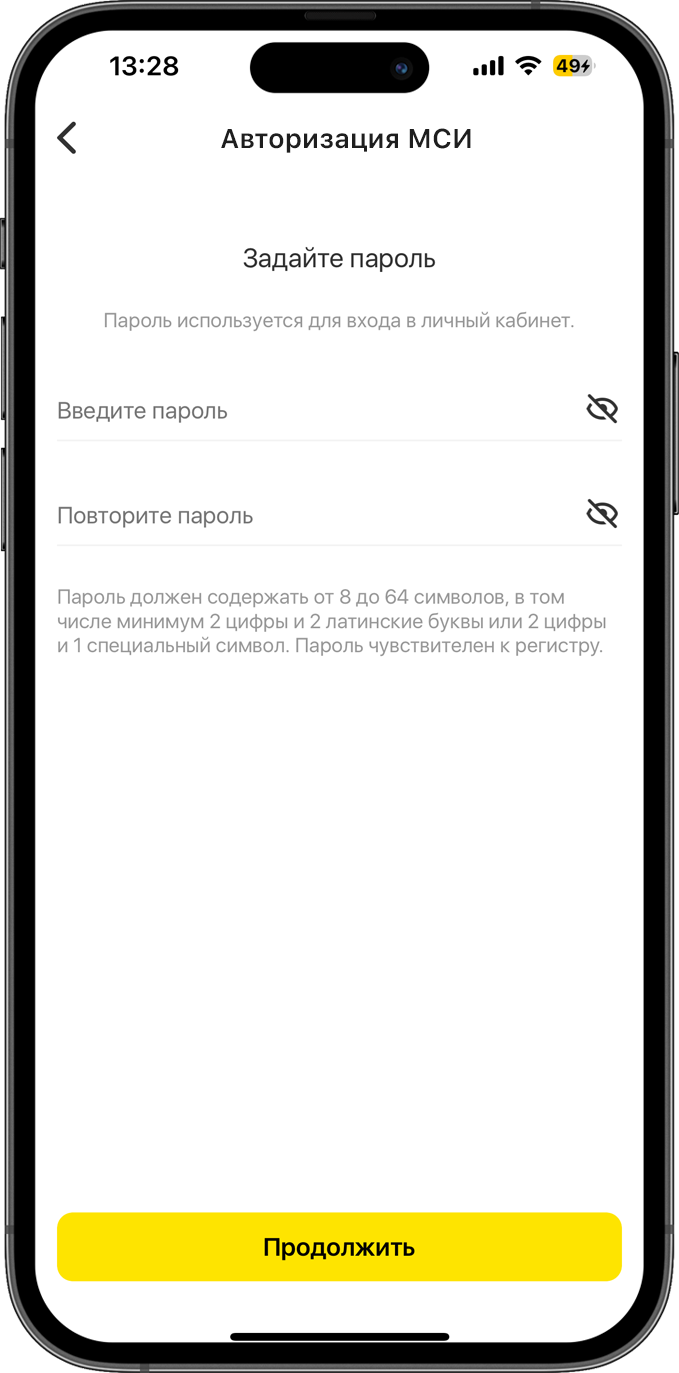

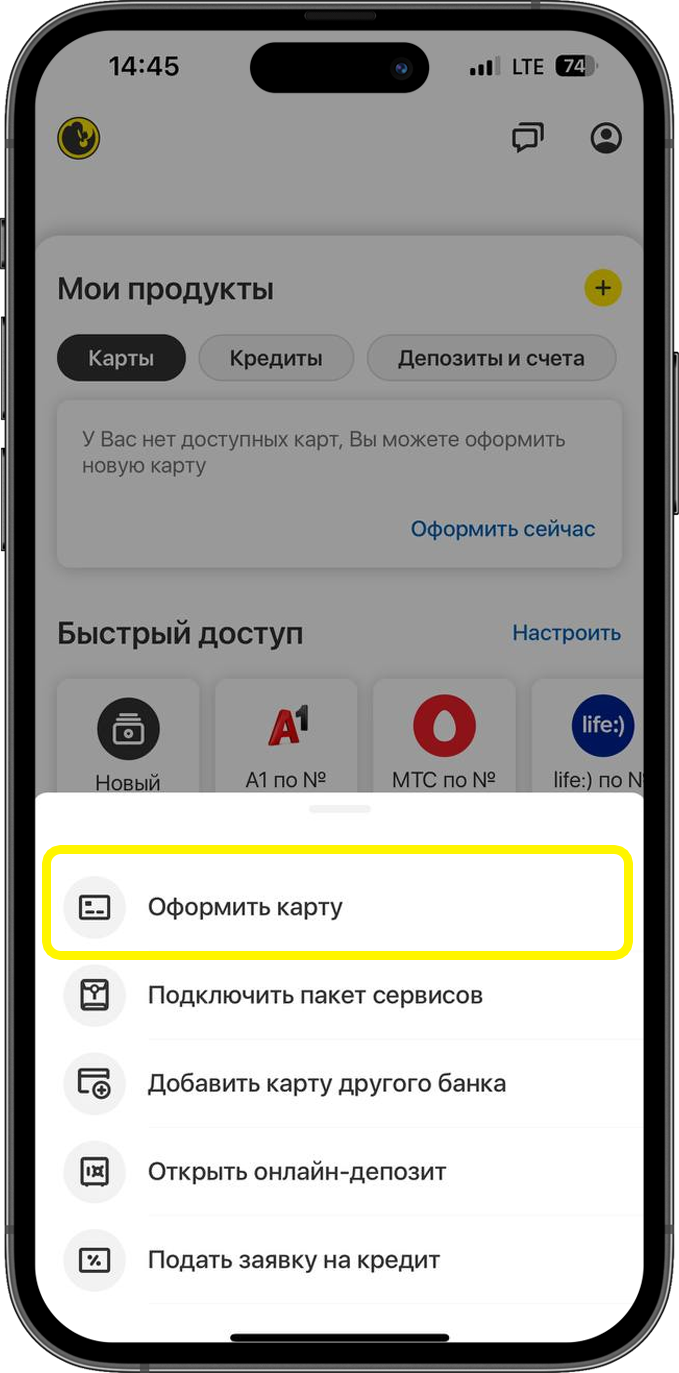

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом