Letters of Credit (LCs)

Expand the geography of your import or export operations while mitigating the risks of delivery failure or delinquent payment.

Letters of Credit (LCs)

Expand the geography of your import or export operations while mitigating the risks of delivery failure or delinquent payment.

Are you planning to expand into new markets? To expand the geography of your import or export operations? To start doing business with new buyers or suppliers from other countries?

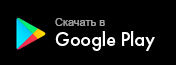

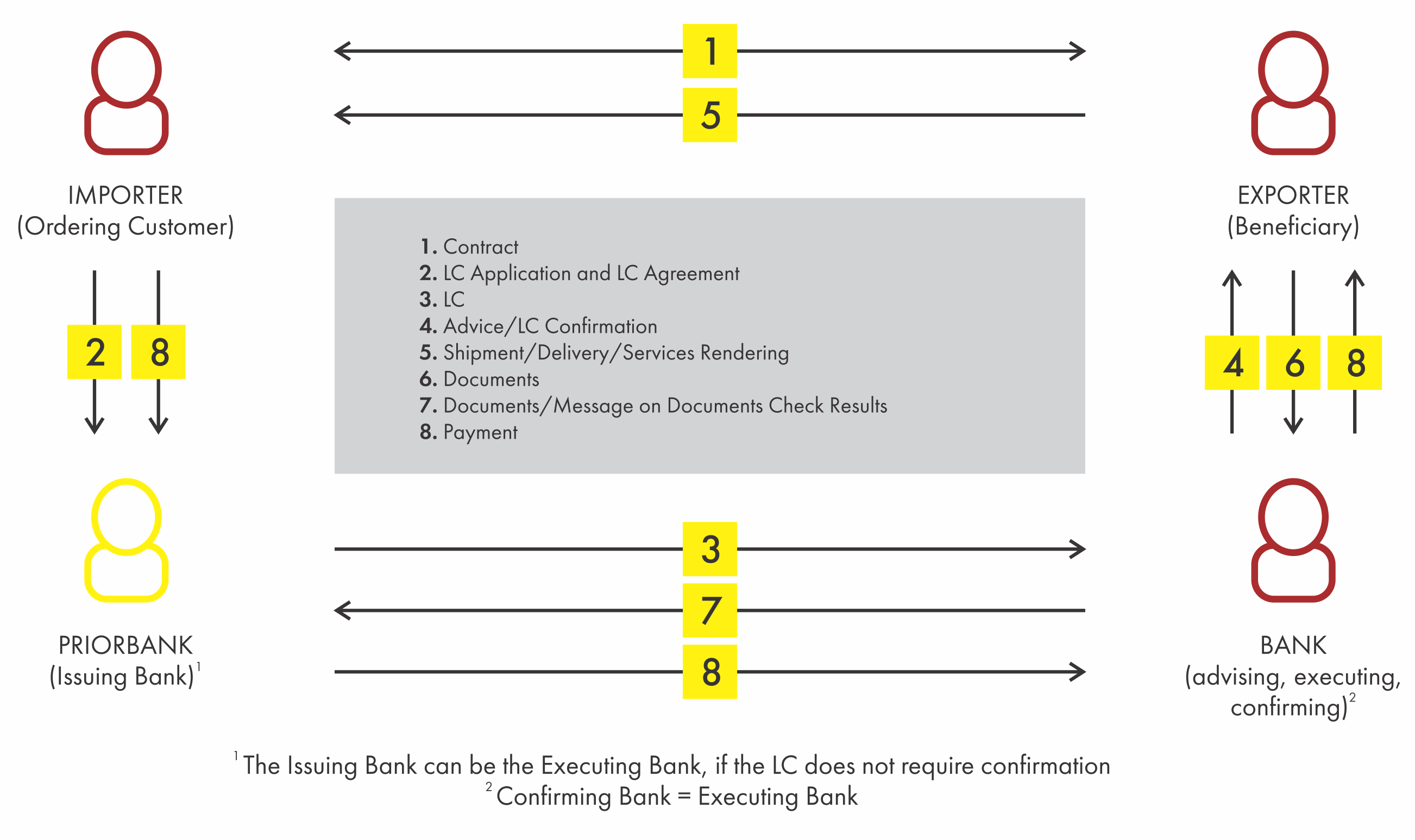

Take advantage of a LC: form of cashless settlements constituting irrevocable obligation of the bank to execute payment against documents, indicated in the LC, evidencing fulfillment by one party (as a rule, LC's Beneficiary) towards the other party (as a rule, LC's Applicant) of the obligations on shipment (delivery) of goods, execution of works, or rendering of services.

The presented documents must comply with the LCs terms, LCs Rules and international standard banking practice.

LC Types

LCs Advantages

-

Risk Mitigation

As the bank pays only against the documents, stipulated by the LC, an importer mitigates risks of failure to deliver goods (execute works, render services) or their improper quality or quantity. An exporter replaces the risk of the importer's delinquent payment with the bank's risk and benefits from the opportunity to receive payment for the goods immediately after shipment.

-

Independence, dealing with documents

LC is a separate transaction from the sale or other contract, stipulating LC as a form of settlements. The bank deals with documents, and not with goods (performance, services) to which the documents may relate. The bank makes a decision to pay under LC based on the presented documents and LC terms.

-

Business expansion

An opportunity to expand the geography of your import or export using LC with the participation of the bank of either the importer or exporter country, or other banks, including international, acceptable for both the importer and the exporter.

-

Financing

Within the LC the importer or exporter financing is possible with the purpose to observe the balance of interests in trade transactions (the exporter immediately receives cash for the shipped (delivered) goods, executed words, rendered services, the importer – under deferred payment).

-

International rules

LCs (including standby LCs) are regulated by the Uniform Customs and Practice for Documentary Credits, published by International Chamber of Commerce (ICC) in 2007 (hereinafter referred to UCP600) being mandatory and binding for all LC parties. UCP600 is a set of rules on the issuance and use of letters of credit.

The banks are also guided by the International Standard Banking Practice for the Examination of Documents under UCP600 (ISBP), ICC Publication no. 745 (the most recent one being the 2013 revision), and other documents issued by ICC.

International Standby Practices (ISP98), ICC Publication No. 590 in 1998, can be applied to standby LCs.

Working within the aforementioned rules contributes to harmonious cooperation among all LC parties ensuring unificated interpretation of LC principles and procedures.

LC for Importers

-

Avoid advance payment

Advance payment is the most risky form of settlement.

-

Mitigate risks associated with the exporter's failure to fulfil their contractual obligations

The payment under LC will be effected after the exporter's documentary confirmation of the fulfillment of their contractual obligations.

-

Cut costs

The LC is cheaper than traditional lending.

The list of fees and commissions applicable to LCs for importers1,6 |

|||

№ |

Operation |

Fee/Commission for LCs in BYN7 |

Fee/Commission for LCs in the foreign currency2,3 |

| 1 | Issuance and administration of a LC:4 | ||

| 1.1 | providing letter of credit draft at the request of the Client |

259.00 BYN |

70.00 EUR |

| 1.2 | LC with the provision of cash equal to the LC amount and more prior to the LC issuance |

0,25% from the LC amount per month, |

0,25% from the LC amount per month, |

| 1.3 | LC without the provision of cash equal to the LC amount prior to the LC issuance (or with a partial provision of funds):5 | ||

| 1.3.1 | - up to 15,000 USD (inclusive), 12,000 EUR, 450,000 RUR, (other currency – in USD equivalent at the exchange rate of NBB as at LC issuance date) |

0,05% from the LC amount per month, |

0,05% from the LC amount per month, |

| 1.3.2 | - exceeding 15,000 USD, 12,000 EUR, 450,000 RUR, (other currency – in USD equivalent at the exchange rate of NBB as at LC issuance date) |

0,05% from the LC amount per month, |

0,05% from the LC amount per month, |

| 2 | Fee/Commission for the LC amount unsecured by the Client's cash |

as agreed by the parties |

as agreed by the parties |

| 3 | Amendment to LC terms and conditions |

185 BYN |

50 EUR |

| 4 | Acceptance, examination of documents under LC |

0,15% from the documents amount, |

0,15% from the documents amount, |

| 5 | Payment under the LC – for each presentation of documents | ||

| 5.1 | under the LC (excluding standby LCs) |

0,15% from the payment amount, |

0,15% from the payment amount, |

| 5.2 | under standby LC |

0,2% from the payment amount, |

0,2% from the payment amount, |

| 6 | Acceptance of documents with discrepancies – for each presentation of documents |

185 BYN |

50 EUR |

| 7 | Early cancellation or reduction of the LC under the Client's request (full or partial) or pursuant to the LC terms and conditions |

185 BYN |

50 EUR |

| 8 | Tele-transmission message fee |

18,50 BYN |

5 EUR |

| 9 | Payment under the LC (excluding standby LCs) upon the Client's request earlier than the established date(additionally collected to the Clause 5) – for each presentation of documents | 110 BYN | 30 EUR |

|

1. Fees and commissions under Priorbank JSC LC shall be payable within the periods stipulated by the agreement. 2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer. 3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Principal (Instructing Party, Debtor, Applicant, Beneficiary), the exchange rate of the National Bank of the Republic of Belarus is applied as at the date: 4. The minimum is calculated based on the number of days of the validity of the obligation under the LC. 5. Upon cash provision the commission is not reviewed. 6. The cost of third parties services (post, courier service, etc.) involved in the aforementioned operations are not included in fees/commissions and shall be additionally paid by the Client upon the Bank's request. 7. Including letters of credit in foreign currency with payments in Belarusian rubles. When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency. 8. Applies to letters of credit issued from 17/04/2023. For letters of credit issued before 17/04/2023, the previously established fee applies. |

|||

1. Fees and commissions under Priorbank JSC LC shall be payable within the periods stipulated by the agreement.

2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer.

3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Principal (Instructing Party, Debtor, Applicant, Beneficiary), the exchange rate of the National Bank of the Republic of Belarus is applied as at the date:

- of accrual (last business day of the month) if the obligation exists, and as at the last day of the obligation, if the obligation terminated;

- of service rendering – for commissions without taking into account the number of days.

4. The minimum is calculated based on the number of days of the validity of the obligation under the LC.

5. Upon cash provision the commission is not reviewed.

6. The cost of third parties services (post, courier service, etc.) involved in the aforementioned operations are not included in fees/commissions and shall be additionally paid by the Client upon the Bank's request.

7. Including letters of credit in foreign currency with payments in Belarusian rubles.When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency.

8. Applies to letters of credit issued from 17/04/2023. For letters of credit issued before 17/04/2023, the previously established fee applies.

Our Services

-

Advising

-

Confirmation

-

Examination of Documents

-

LC for exporter

-

Guaranteed payment for goods (works, services)

As the LC constitutes the bank's financial obligation, separate from the sale contract, the LC settlement form significantly mitigates the risk of delinquent payment for exported goods (works, services) assisting the exporters to expand to new markets.

If the exporter cannot accept the risk of the LC Issuing Bank or the country of its origin, the LC can be confirmed by Priorbank. -

Receiving of export revenues after the goods have been shipped (works have been executed, services have been rendered)

LC settlement enables to receive export revenues immediately after the goods have been shipped (works have been executed, services have been rendered) upon documentary confirmation of the goods shipment (works execution, services rendering) for the importer. This increases the exporter's finances management efficiency and contributes to the development of trusting relationships with the importer.

-

Control and Timely Payments

Payments under the LCs are executed according to the periods, stipulated by the LC terms and conditions. After the documents are submitted, the banks control have over the timely payments under the LC, which improves the quality of export revenues inflow and distribution planning.

The list of fees and commissions applicable to LCs for exporters1,4 |

|||

№ |

Operation |

Fee/Commission for LCs in BYN6 |

Fee/Commission for LCs in the foreign currency2,3 |

| 1 |

Preliminary advice |

110 BYN |

30 EUR |

| 2 |

Advising or confirmation of the LC authenticity |

0,15% from the LC amount, |

0,15% from the LC amount, |

| 3 |

Advising or confirmation of the authenticity of the amendment to the LC |

185 BYN |

50 EUR |

| 4 |

Acceptance, examination of documents under LC and sending (if necessary) |

0,15% from the amount of documents, |

0,15% from the amount of documents, |

| 5 |

Acceptance, sending of documents without examination and payment crediting under LC advised through Priorbank |

222 BYN |

60 EUR |

| 6 | Acceptance, sending of documents without examination and payment crediting under LC advised through another bank | 370 BYN | 100 EUR |

| 7 |

Transfer of the LC in favor of another beneficiary |

0,3% from the amount, |

0,3% from the amount, |

| 8 |

Reimbursement claim |

110 BYN |

30 EUR |

| 9 |

Tele-transmission message fee |

18,50 BYN |

5 EUR |

| 10 | Discounting of the Obligation of the Deferred Payment under the LC5 | ||

| 10.1 | Discounting arrangement fee | 370 BYN | 100 EUR |

| 10.2 | Fee for cash provision |

as agreed by the parties, |

as agreed by the parties, |

| 11 |

Message transfer under LC |

110 BYN |

30 EUR |

| 11.1 |

- to the Client at the request of another bank |

||

| 11.2 |

- to another bank at the request of the Client |

||

| 12 |

Payment of other bank's commission (due to be paid by the Client) by debiting funds from the Client’s current account - for each payment |

37 BYN |

10 EUR |

| 13 | Investigation upon the Client's request of the amount deducted from payment under LC and informing the Client - for each payment | 110 BYN | 30 EUR |

| 14 | Confirmation of the client's payment details subject to his consent at the request of another bank (upon presentation of documents by the client to another bank without participation of Priorbank JSC) | 110 BYN | 30 EUR |

|

1. Fees and commissions under other banks' LCs shall be payable until the 10th day of the month, following the month of the respective service rendering. 2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer. 3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Principal (Instructing Party, Debtor, Applicant, Beneficiary), the exchange rate of the National Bank of the Republic of Belarus is applied as at the date: 4. The cost of third parties services (post, courier service, etc.) involved in the aforementioned operations are not included in fees/commissions and shall be additionally paid by the Client upon the Bank's request. 5. Fees/commissions shall be payable within the periods stipulated by the agreement in the discounting currency. If the discounting currency differs from the discounting arrangement fee, it shall be paid at the basic exchange rate set by the Bank as at the date of the written notification by the Bank on the date of the planned discounting and calculation of the discounting remuneration amount. The minimum is calculated based on the number of days of the Issuing Bank's obligations validity. 6. Including letters of credit in foreign currency with payments in Belarusian rubles. When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency. |

|||

1. Fees and commissions under other banks' LCs shall be payable until the 10th day of the month, following the month of the respective service rendering.

2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer.

3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Principal (Instructing Party, Debtor, Applicant, Beneficiary), the exchange rate of the National Bank of the Republic of Belarus is applied as at the date:

- of accrual (last business day of the month) if the obligation exists, and as at the last day of the obligation, if the obligation terminated;

- of service rendering – for commissions without taking into account the number of days.

4. The cost of third parties services (post, courier service, etc.) involved in the aforementioned operations are not included in fees/commissions and shall be additionally paid by the Client upon the Bank's request.

5. Fees/commissions shall be payable within the periods stipulated by the agreement in the discounting currency. If the discounting currency differs from the discounting arrangement fee, it shall be paid at the basic exchange rate set by the Bank as at the date of the written notification by the Bank on the date of the planned discounting and calculation of the discounting remuneration amount. The minimum is calculated based on the number of days of the Issuing Bank's obligations validity.

6. Including letters of credit in foreign currency with payments in Belarusian rubles. When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency.

.png)

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом