Discounting

Discounting of the Obligation of the Deferred Payment under the LC

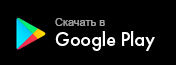

With the purpose to stimulate and develop export, Priorbank offers the service of discounting of the obligation of the deferred payment under the LC (hereinafter referred to as discounting) by granting the deferred payment to the importer and closing of the foreign trade transaction by the exporter after shipment (delivery) of goods, execution of works, rendering of services, using the LC.

Discounting – provision of funds to the exporter by the Nominated Bank (Priorbank) prior to the maturity date under the LC with the deferred payment, provided the exporter has presented to Priorbank the documents constituting a complying presentation (the presented documents must comply with the LCs terms and conditions, applicable rules and international standard banking practice).

Advantages of Discounting for the Exporter

-

Export Geography Expansion

Discounting enables to increase competitiveness of sales by providing to the importer of the deferred payment for the shipped goods, executed works or rendered services.

-

Efficient Finances Management

The exporter is provided with an opportunity to receive export revenues and close the foreign trade transaction immediately after the goods have been shipped (delivered), works have been executed, services have been rendered.

-

Receiving of cash from the bank under the simplified procedure

Discounting is provided with the right to receive reimbursement to the amount of the due representation under the LC from the Issuing Bank upon the maturity of payment under the LC according to the deferral.

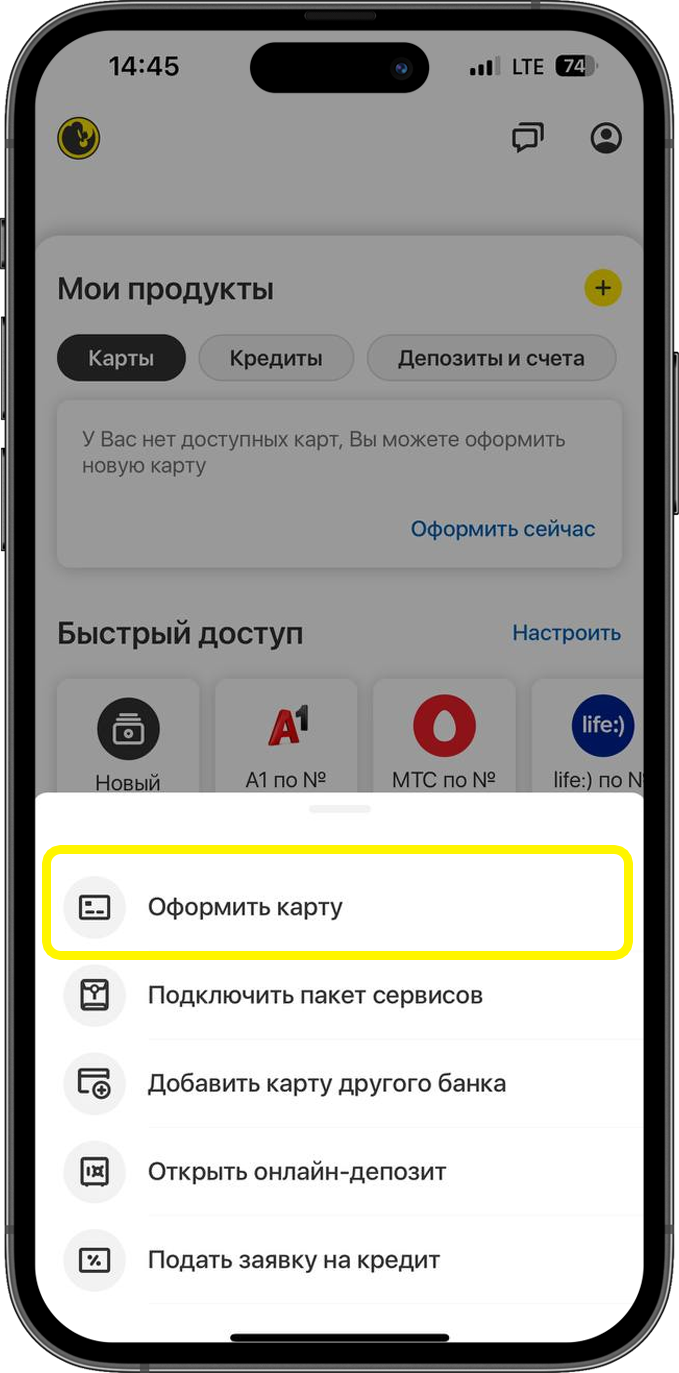

How to use the service

-

Step 1.

Conclude a foreign trade contract

Conclude with the importer the foreign trade contract stipulating LC settlement form for export.

-

Step 2.

Receive the LC

Receive the LC with deferred payment (minimum 15, maximum 180 days) with instructions on its confirmation in Priorbank.

-

Step 3.

Apply to Priorbank

Conclude with Priorbank the discounting agreement.

Submit to Priorbank the documents under the LC and discounting instructions, assign to Priorbank the rights to claim and receive the revenues under the LC.

Pay remuneration to Priorbank for discounting.

-

Step 4.

Receive cash

Receive cash to current (settlement) account with Priorbank.

List of Fees and Commissions for Discounting of the Obligation

|

||

Operation |

Fee/Commission for LCs in BYN4 |

Fee/Commission for LCs in the foreign currency2,3 |

Discounting arrangement fee |

250 BYN |

100 EUR |

Fee for cash provision |

as agreed by the parties, minimum - 125 BYN per month | as agreed by the parties, minimum - 50 EUR per month |

|

1. Fees/commissions shall be payable within the periods stipulated by the agreement in the discounting currency. If the discounting currency differs from the discounting arrangement fee, it shall be paid at the basic exchange rate set by the Bank as at the date of the written notification by the Bank on the date of the planned discounting and calculation of the discounting remuneration amount. The minimum is calculated based on the number of days of the Issuing Bank's obligations validity. 2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer. 3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Applicant, the exchange rate of the National Bank of the Republic of Belarus is applied as at the date: 4.Including letters of credit in foreign currency with payments in Belarusian rubles. When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency. |

||

1. Fees/commissions shall be payable within the periods stipulated by the agreement in the discounting currency. If the discounting currency differs from the discounting arrangement fee, it shall be paid at the basic exchange rate set by the Bank as at the date of the written notification by the Bank on the date of the planned discounting and calculation of the discounting remuneration amount. The minimum is calculated based on the number of days of the Issuing Bank's obligations validity.

2. The Fee/Commission can be paid in the LC currency or in other currency (pursuant to the foreign currency legislation) at the exchange rate set by Priorbank JSC for currency exchange operations with the Clients at the payment date, if otherwise is not stipulated by the agreement or on the date of payment by a payer who is not a bank customer.

3. If the transaction currency does not correspond with the currency of minimum (maximum) upon calculation of fees/commissions payable by the Applicant, the exchange rate of the National Bank of the Republic of Belarus is applied as at the date:

- of accrual (last business day of the month) if the obligation exists, and as at the last day of the obligation, if the obligation terminated;

- of service rendering – for commissions without taking into account the number of days.

4.Including letters of credit in foreign currency with payments in Belarusian rubles. When calculating the amount of the fee, expressed as a percentage of the amount in foreign currency, the conversion into Belarusian rubles is carried out at the official rate of the Belarusian ruble at the date of the provision of the service established by the National Bank of the Republic of Belarus in relation to the corresponding foreign currency.

.png)

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом