Two-Factor Export Factoring without Recourse

Exclusive opportunities for Belarusian exporters to receive financing while simultaneously covering the risk of delinquent payment under foreign trade contracts

Two-Factor Export Factoring without Recourse

Exclusive opportunities for Belarusian exporters to receive financing while simultaneously covering the risk of delinquent payment under foreign trade contracts

Exclude financial risks, increase sales, expand to new markets and widen sales geography together with Priorbank.

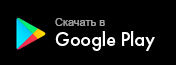

Export factoring without recourse or export two-factor factoring represents exclusive opportunities for Belarusian exporters to receive financing while simultaneously covering the risk of delinquent payment under foreign trade contracts.

Priorbank is the first bank in Belarus - to be a participant of the international factoring association Factors Chain International (FCI) where the total number of members exceeds 400 banks and factoring companies. Therefore, you have an opportunity to conclude transactions under the comfortable terms and conditions across more than 80 worldwide markets.

Factoring Terms and Conditions

Factoring Type: Factoring with notification of the foreign buyer regarding Assignment of Accounts Receivables (A/R)

Financing Size: up to 100% from the amount of the assigned A/R less the discount.

Financing Currency: the currency corresponds to the contractual currency.

Maximum payment terms: up to 120 calendar days.

Limits: the financing is provided within the limits established by the export-factor for the seller and the import-factor for the buyer.

Attention! The bank finances the seller on the cash claims, maturity of which has not elapsed as of the financing date. The import-factor can demand to transfer for administrative management all the volume of the receivables of the debtor, on which the cash obligations financing limit was established.

Factoring Advantages

-

Reliable Partner

Priorbank has been operating on the Belarusian factoring market since 2010, and is a member of the international factoring association Factors Chain International (FCI).

Priorbank was recognised as the best on the international factoring market by the International Factors Group (IFG) in 2014. Today IFG is a part of the FCI (since 2016).

-

Quick and Convenient Financing

Receiving of funds to the current account on the day of documents provision related to shipment.

-

Long-Term Deferral

Longer deferrals to your buyers.

-

Customer Base Growth

Possibility to start cooperation with new buyers under deferred payment conditions, excluding mistrust between your company and the client.

-

Unsecured

Possibility to receive financing without traditional collateral.

-

A wide services package

Accounting and administration of receivables + protection from debts + cover delinquent payment risks.

-

For Any Purposes

Possibility to dispose of the funds at your discretion.

-

Compliance with foreign trade legislation

Closing of foreign trade transactions and ensuring return of the FCY revenues at the moment of financing receiving.

-

Factoring services according to international standards

Priorbank is a member of the international factoring association FCI, which enables to execute factoring transactions applying the best international practices.

.png)

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом