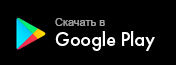

Import Factoring

A highly in demand type of factoring which enables Belarusian importers deferred payment of up to 90 calendar days, and enables non-resident exporter to receive payment on the shipment date.

Import Factoring

A highly in demand type of factoring which enables Belarusian importers deferred payment of up to 90 calendar days, and enables non-resident exporter to receive payment on the shipment date.

Fast Working Capital Replenishment

Exclusion of cash gaps, possibility to provide competitive payment deferrals to the buyers and the ability to clearly plan cash flow.Factoring type: open factoring, i.e. the seller notifies the buyer about the Assignment of Accounts Receivables (A/R).

Limits: the seller is guaranteed the payment for the goods within the limit established for the buyer

Maximum Payment Terms: up to 90 calendar days.

Requirements of the Contract:

- lack of an assignment ban / permission for further assignment;

- lack of possibility to return proper goods;

- only Priorbank accounts in requisites;

- applicable law – laws of the Republic of Belarus / place of disputes settlement – economic or arbitrary court in buyer's jurisdiction;

- penalties for failure to fulfill the obligations – to be agreed with Priorbank.

Factoring Advantages

-

Reliable Partner

Priorbank has been operating on the Belarusian factoring market since 2010, and is a member of the international factoring association Factors Chain International (FCI).

Priorbank was recognized as the best on the international factoring market by the International Factors Group (IFG) in 2014. Today the IFG is a part of the FCI (since 2016).

-

Seller’s Financing

The seller can receive payment for the goods on the shipment date.

-

Deferred Payment

Possibility to receive long deferral from the seller.

-

Seller's Confidence

A guaranteed payment for the goods or service

-

New Partners

Opportunity to cooperate with new sellers under the deferred payment condition.

.png)

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом

SMS по всем расходным операциям за рубежом, в т.ч. на Интернет-сайтах, зарегистрированных за рубежом